General rules

(a) Causative Act

This is a staff member ' s retirement or retirement and may occur for a variety of reasons:

(b) Period of absence

A minimum period of 15 years of actual service to the State is a prerequisite for entitlement to an ordinary retirement or retirement pension.

(c) Pension calculation

The amount of the ordinary retirement or retirement pension is determined by applying the percentage established on the basis of the number of full years of actual service to the State to the having regulator, depending on the staff member ' s body or grade.

- Regulatory assets (bases for the calculation of Passive Class pensions): these are fixed annually in the Law on General State Budgets for each group, subgroup (EBEP Royal Legislative Decree 5/2015) of classification in which the different bodies, scales, positions or jobs of civil servants are located.

By 2025, they are as follows:

EBEP Group/Subgroup | Having a regulator (euros/year) |

|---|

| A1 | 51,311.65 |

| A2 | 40,383.55 |

| B | 35,362.35 |

| C1 | 31,015.26 |

| C2 | 24.538.21 |

| E (Law 30/1984) and Professional Groups (EBEP) | 20,920.79 |

- The appropriate percentage shall be applied to the appropriate base or regulator in accordance with the following scale:

Years of service | Percentage of the regulator | Years of service | Percentage of the regulator | Years of service | Percentage of the regulator |

|---|

| 1 | 1.24 | 13 | 22.10 | 25 | 63.46 |

| 2 | 2.55 | 14 | 24.45 | 26 | 67.11 |

| 3 | 3.88 | 15 | 26.92 | 27 | 70.77 |

| 4 | 5.31 | 16 | 30.57 | 28 | 74.42 |

| 5 | 6.83 | 17 | 34.23 | 29 | 78.08 |

| 6 | 8.43 | 18 | 37.88 | 30 | 81.73 |

| 7 | 10.11 | 19 | 41.54 | 31 | 85.38 |

| 8 | 11.88 | 20 | 45.19 | 32 | 89.04 |

| 9 | 13.73 | 21 | 48.84 | 33 | 92.69 |

| 10 | 15.67 | 22 | 52.52 | 34 | 96.35 |

| 11 | 17.71 | 23 | 56.15 | 35 or more | 100 |

| 12 | 19.86 | 24 | 59.81 | | |

Calculate the amount of your theoretical pension:

Special assumptions

(a) Service provision in two or more Corps

Where services have been provided in two or more Corps or categories with different regulators, the staff member ' s entire administrative record is taken into account in calculating the retirement or retirement pension, from his or her entry into the first and subsequent Corps to his or her termination from active service. To this end, the following formula applies:

P = R1 x C1 + (R2 - R1) x C2 + (R3 - R2) x C3 + …

Being:

P the annual amount of the retirement or retirement pension

R1, R2, R3 ... the regulatory assets corresponding to the first and subsequent Bodies and Scales in which it had provided services

C1, C2, C3 ... the percentages of calculation corresponding to the full years of effective service from access to the first Corps, Scale ... until the time of retirement or retirement, according to the above table of percentages.

For the purpose of determining the applicable percentage, the time fractions above the year shall be computed as the time corresponding to the services provided thereafter until the services recently provided are reached where the resulting excess time will not be computed.

(b) Pensions in the event of protracted active service

In accordance with the amendment introduced, by Law 21/2021, of 28 December, on guaranteeing the purchasing power of pensions and other measures to strengthen the financial and social sustainability of the public pension system, in the seventeenth additional provision of the Consolidated Text of the Law on Passive Classes of the State, approved by Royal Legislative Decree 670/1987, of 30 April, to the retirement pensions of the Regime of Passive Classes of the State that are caused from 1 January 2022, the provisions of Article 210 of the Royal Decree-Law No. In application thereof:

- In general, it shall apply to pensions declared at an age higher than the age of compulsory retirement corresponding to the staff member ' s Corps of Membership, provided that the minimum period of absence of 15 years is met at that age.

- In the case of judges, magistrates, public attorneys, prosecutors, lawyers of the Administration of Justice, university professors and property, commercial and personal property registrars, who cause pensions on or after 1 January 2015, they shall be required to be at least sixty-five years old at the time of retirement, as well as the judges and prosecutors of the Supreme Court who on that date were serving as emeritus.

The person concerned shall be granted an economic supplement, for each full year of effective services to the State that has elapsed since he or she became eligible for this pension, which shall be paid in one of the following ways, at the choice of the person concerned:

(a) An additional percentage of 4 per cent for each full year paid between the date of attainment of the age of compulsory retirement and that of the event giving rise to the pension. From the second full year of delay, periods longer than 6 months and shorter than one year may be computed for the calculation of the percentage, with an additional 2% corresponding to these periods.If the amount of the pension with the increase exceeds the maximum limit for the receipt of public pensions (Euro3,267.60/month for the year 2025), an additional amount may be received which, in addition to the pension, may not be higher since there is a regulator of the Group/Subgroup A1 (Euro3,665.12/month for the year 2025).

EUR 3,665.12 – EUR 3,267.60 = EUR 397.52/month.

(b) An amount as a lump sum for each full year paid between the date on which he attained the age of compulsory retirement and that of the event giving rise to the pension, the amount of which shall be determined on the basis of the years of actual service to the State credited on the first of the dates indicated, the calculation formula being as follows:

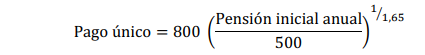

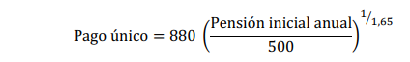

1. If you have paid contributions for less than 44 years and 6 months:

If you have paid contributions for at least 44 years and 6 months, the previous figure is increased by 10%:

2. From the second full year of delay, periods longer than 6 months and shorter than one year may be computed for the calculation of the supplement, these periods being the result of multiplying the amount of the previous formula by 0.5.

![]() (c) A combination of the above solutions on such terms as may be determined by regulation.

(c) A combination of the above solutions on such terms as may be determined by regulation.

Therefore, when the interested parties, from the second year of extension, have provided services comprising fractions of years longer than 6 months and less than one year, they will only be able to opt for options (a) and (b).

However, in order to avoid as far as possible pensioners wishing to avail themselves of the mixed option being adversely affected by the delay in the adaptation of the current RD 371/2023 of 16 May (BOE 117 OF 17/05/2023), the mixed option may be chosen provided that the event giving rise to the pension has taken place from 19 May 2023 and that pensioners have delayed access to retirement for at least two full years and without additional extended years of more than six months.

Once these conditions have been met, if the person concerned opts for this modality, the supplement will be calculated taking the full years of service to the State that are accredited, although the calculation rules are different depending on whether between the date of forced retirement and the event causing the pension ten years or more than 10 years have elapsed:

• If between forced retirement and the event giving rise to the pension between 2 and 10 years have elapsed, an additional 4 per cent is applied for each year in the middle of that period, and a lump sum for the rest.

• If 11 years or more have elapsed between forced retirement and the event giving rise to the pension, a lump sum is applied for 5 years of that period, and an additional 4 per cent for each of the remaining years.

The choice shall be made only once at the time when the right to receive the economic supplement is acquired, and may not be modified subsequently. If this power is not exercised, the complemento referred to in point (a) shall apply (additional percentage of 4%).

The percentage increase obtained in no case has an impact on the calculation of pensions in favour of family members.

As a novelty introduced by the recent reform carried out by RDL 11/2024, the receipt of the supplement for late retirement age, in all forms - additional percentage, single and mixed capital - is compatible with the access to active retirement regulated in Article 33.2 TRLCPE.

However, as long as the person remains in active retirement, no increase in the supplement will be generated.

(c) Computation of services in retirement or retirement pensions for incapacity or uselessness

The retirement or retirement pension due to permanent incapacity/uselessness for service is calculated in the same way as the ordinary retirement or retirement pension due to age, with the particularity that when it occurs while the staff member is in active service or in a comparable situation, the full years remaining to the staff member to meet the retirement or forced retirement age shall be considered as effective services, in addition to those accredited up to that time, understood as provided in the Corps, Scale, place, employment or category in which it is attached at the time of the retirement or retirement cessation.

However, from 1 January 2009, if, at the time of the event giving rise to the event, the person concerned accrues less than 20 years of service and the incapacity or uselessness does not disqualify him or her for any profession or trade, the amount of the ordinary retirement or retirement pension shall be reduced by 5% for each full year of service he or she lacks until he or she has completed 20 years of service, with a maximum of 25% for those who accredit 15 or fewer years of service. If, after recognition of the pension and before the age of retirement or compulsory retirement, there is an aggravation of the illness or injury of the person concerned in such a way as to disqualify him or her from performing any profession or trade, the amount of the pension may be increased to 100 per cent of the amount due to him or her.

(d) Change from body to body with a different proportionality index before 1 January 1985 - T1D in the consolidated text of the Passive Classes Act -

The First Transitional Provision of the Consolidated Text of the Law on Passive Classes of the State provides that the civil and military personnel of the State Administration, entered before 1 January 1985, and who before that date had gone from a body, scale, place or employment, which had a certain proportionality index assigned to it, to provide services in another of a higher proportionality index, shall be entitled to be counted, for the purposes of calculating their pension, up to a maximum of ten years of those actually served in the body, scale, place or employment of the lesser of the proportionality indices, if they had been provided in the greatest proportionality.

This special computation of services exempts pensions caused by the staff member ' s voluntary retirement or retirement.

(e) Compulsory military service, alternative social service and compulsory female social service

For the purposes of passive entitlements, compulsory military service, equivalent social benefit and compulsory female social service - now abolished - are only taken into account for the determination of civil servants' pensions when they have been completed after their entry into the civil service.

If they had served before acquiring the status of civil servant, only the time exceeding compulsory military service and compulsory female social service is counted.

(f) Reciprocal computation of contributions between social security schemes

Royal Decree 691/1991, of 12 April, on the reciprocal calculation of quotas between social security schemes, allows, at the request of the interested party, to totalize the successive or alternative contribution periods that are accredited in the State Passive Classes Scheme and in the Social Security System schemes, both for the acquisition of the right to pension and for determining the percentage applicable for the calculation of the same.

The pension is recognized by the Management Body or Entity of the scheme to which it has made the last contributions, applying its own rules but taking into account the totalization of periods, unless it did not meet the conditions required to obtain the right to a pension, in which case it will resolve the other scheme. In the event that the latest quotations were simultaneous, the competence for the decision lies with the scheme for which the highest quoted period was accredited.

When the recognition of the pension is appropriate to the Passive Classes Scheme, the contribution periods that are totaled, accredited in another scheme, shall be understood as being paid in the group or category that results from applying the following table of equivalences:

| Social Security | Regime of Passive Classes |

|---|

| 1 (Group 1 + Self-employed graduates and engineers) | A1 |

| 2 (Group 2 + Self-employed Ingen. Technicians and experts) | A2 |

| 3 (groups 3, 4, 5, 8 and Self-employed in general) | C1 |

| 4 (Group 7 and 9) | C2 |

| 5 (groups 6, 10, 11, 12 and female domestic workers) | E/Professional groupings |

In order to incorporate the years of contributions in the Passive Classes Scheme into social security pensions, in application of the reciprocal calculation of contributions between social security schemes (Royal Decree 691/1991 of 12 April), the person concerned must apply for the certification of services provided to the State to be carried out on the Model CS form issued by the ministerial department or the Autonomous Community where the official was last assigned.

(g) Secularized priests and religious

Royal Decree 432/2000, of 31 March, regulates the computation in the State Regime of Passive Classes of periods recognized as social security contributions, in favour of priests, religious or religious of the Catholic Church, as well as secular members of any of the secular institutes of the Catholic Church that are registered in the Register of Religious Entities of the Ministry of Justice, which, on 1 January 1997, was secularized, ceased in the religious profession or as a member of such secular institutes.

The aforementioned Royal Decree allows such periods to be totalized, at the request of the interested parties and provided that they do not overlap with the years of services that are accredited in the State Passive Class System, both to cause the right to pension in this social protection system and to improve the amount of it, without in any case the years resulting from the expressed totalization being able to exceed the number of thirty-five.

The most relevant aspects to take into account are the following:

1. The application of the person concerned must be accompanied by a certification specifying the periods assimilated to recognized contributions and, where appropriate, those of actual contribution, issued by the Provincial Directorate of the General Treasury of Social Security of the person concerned ' s place of residence or, if he/she resides abroad, by the locality where he/she exercised the priestly ministry or religious profession at the time of his/her secularization, or as a secular member of a secular institute of the Catholic Church, at the time of his/her dismissal.

2. For the purposes of calculating the pension, the periods of exercise of the priestly ministry or religious profession, which are recognized by the General Treasury of Social Security as having been assimilated to contributions, shall be understood as those of services rendered to the State in subgroup C1.

3. The persons concerned are obliged to pay exclusively the part of the total amount of the pension that corresponds for the years assimilated to contributions that are computed for the recognition of the right to a pension, or improvement of the one already recognized. This part shall be calculated by applying, since there is a regulator of subgroup C1, the percentage fixed in the scale of article 31.1 of the Consolidated Text of the Law on Passive Classes for an equal number of years as those calculated as assimilated to listed.

4. The amount payable will be deducted in the successive monthly pension payments that are accrued, including the extraordinary ones, without, in any case, the amount deducted monthly being able to be greater than the difference existing, on the initial date of payment, between the amount of the pension paid (once the taxes have been deducted) and the amount that would have been due without the calculation of the years recognized as contributory. This clause ensures that no amount will be deducted in excess of the amount by which their pension is improved as a result of the calculation of years of religious exercise.

5. The fee to be paid is considered a tax-deductible expense, included in article 19 of Law 35/2006, of 28 November, of the Federal Tax Institute.

(h) Loss of official status

Staff included in the subjective scope of the State Passive Class System - except those referred to in article 2.1 (i) and (j) of the Consolidated Text of the Passive Class Act- who lose the status of official shall retain the passive rights which they or their family members may have acquired up to that time.

However, such staff shall only be entitled to an ordinary retirement pension or retirement pension for permanent incapacity/uselessness if, before reaching retirement age or retirement age, they are completely incapacitated for the performance of any profession or trade.

The recognition of passive entitlements caused by such personnel shall always be made at the request of the party, once it has established compliance with the requirements required in each case, without the need for a prior declaration of retirement or retirement. For the purposes of such recognition, only the services provided by the deceased shall be counted up until such time as the loss of official status has occurred.

(i) Maternity supplement for retirement or forced retirement pensions or for permanent incapacity/uselessness caused from 1 January 2016 to 3 February 2021

As a result of the judgment of the Court of Justice of the European Union of 12 December 2019, applicable to the 18th additional provision TRLCPE in its wording prior to Royal Decree-Law 3/2021, from 1 January 2016 both parents, regardless of their gender, may have access to the right to the recognition of the maternity allowance, provided that they have had natural or adopted children and are beneficiaries of a retirement or forced retirement pension or of permanent incapacity/uselessness for service, subject to the condition that the allowance to be granted must be unique, so that only one of the parents and not both may be beneficiaries of the allowance.

They shall be granted a pension supplement for an amount equivalent to the result of applying to their retirement or retirement pension a percentage based on the number of children born or adopted prior to the event giving rise to the pension, according to the following scale:

- In the case of two children: 5 per 100.

- In the case of 3 children: 10 per 100.

- In the case of 4 or more children: 15 per 100.

This maternity allowance shall in no case form part of the retirement or retirement pension for the purpose of determining the regulatory basis for the recognition of pensions in favour of family members.

In addition:

a.If the pension to be supplemented totals periods in accordance with international standards, the supplement shall be calculated on the basis of the theoretical pension, which in no case may exceed the ceiling for public pensions.

b. If the amount of the pension to be recognised is equal to or greater than the maximum pension limit, only 50 per cent of the supplement shall be paid even if there is a public pension pool.

c. If the pension to be recognized does not reach the minimum pension amount and the person concerned applies for and meets the requirements for the minimum allowance, the maternity allowance shall be added.

d. If there is concurrence of public pensions, regardless of the regime in which they are caused, a single maternity allowance shall be paid in accordance with the following rules:

- If it is more than one retirement or retirement pension, the higher amount of the supplement shall be paid.

- If it is a retirement or retirement and widow ' s pension, the corresponding pension shall be paid.

(j) Gender gap reduction supplement

The supplement for the reduction of the gender gap will be recognized only for retirement or retirement pensions of a forced nature, or for permanent incapacity for service or uselessness caused from 4 February 2021, when one or more sons or daughters have been born.

Following the adoption of the CJEU Judgment of 15 May 2025 and pending a legislative amendment to adapt the provisions of the nineteenth additional provision of the State Passive Classes Act (DA 18 LCPE) to that Judgment, this supplement (CBG) must be applied to men in the same terms as those provided for women, while maintaining the unitary form of the benefit, according to which the parent receiving the smallest pension must be recognized.

Ethe amount of the supplement will be EUR 35.90 per month for each child for the year 2025. The amount to be received shall be limited to four times that amount.

In addition:

- The amount of the supplement will not be taken into account in the application of the pension ceiling.

- The supplement shall be paid in fourteen instalments, together with the pension which determines the entitlement to it.

- Each child shall be entitled only to the recognition of an economic supplement.

- The supplements that could be recognised in any of the Social Security schemes will be incompatible with each other, being paid in the scheme in which the person responsible for the pension has more periods of discharge.

Temporary maintenance of the maternity allowance in Passive Class pensions.

Those who are receiving the maternity allowance will maintain their entitlement.

The receipt of this maternity allowance will be incompatible with the allowance for the reduction of the gender gap that may be due to the recognition of a new public pension, with the persons concerned being able to choose between one or the other.

In the event that the other parent of one of the sons or daughters who gave entitlement to the maternity allowance, requests the allowance for the reduction of the gender gap and is entitled to it, the monthly amount recognized shall be deducted from the maternity allowance received.